🔓 Unlock Your AlphaProfit Edge for 2026

Stay aligned with the strongest sectors and themes using AlphaProfit’s ValuM‑driven sector rotation methodology — the disciplined, research‑based framework powering our ETF and Fidelity model portfolios.

- 🗓️ Model Portfolio Repositioning Alert Dec. 31 — ETF Core, ETF Focus, Fidelity Core & Fidelity Focus

- 📂 Sector & thematic ETFs and Fidelity funds drive disciplined, rules‑based allocation

- 📊 ETF portfolios compounding at 17.4% annually

- 📊 Fidelity portfolios compounding at 17.6% annually

- 📈 Top sectors for 2026: Information Technology, Materials, Industrials, Energy

- 🎯 ValuM multi‑factor framework built for consistent, repeatable performance

What You Get With AlphaProfit Premium

- ETF Core & Focus portfolios

- ETF Style Rotation Model Portfolio

- Fidelity Core & Focus portfolios

- Stock recommendations

- Income ETF recommendations

- Asset allocation guidance

- Sector & theme leadership insights

- Timely repositioning alerts — no daily monitoring required

Special offer available after registration

Get started for just $129 — details sent upon sign‑up.

Take Charge of Your Investments

Sign up for FREE investment newsletter AlphaProfit MoneyMatters

Put Your Investments on the Right Track

You will own the best ETFs, best mutual funds, and best stocks chosen by AlphaProfit’s prescient investment selection system for strong performance in the market ahead.

Read More

Minimize Your Risk

You will use three proven risk reduction strategies to minimize losses during bearish periods without reducing your returns in bull markets.

Read More

Minimize Your Costs

You will keep a tight lid on your investing expenses.

You will invest in low-cost ETFs.

You will invest in no-load, no-transaction-fee mutual funds without incurring short-term redemption fees.

You will stop paying hefty fees or commissions to your investment advisor (if you currently have one).

Read More

Minimize Your Effort with AlphaProfit Investment Newsletter

Investment research is a full-time activity. Part-time dabbling often leads to frustration and financial losses. By outsourcing your investment research to AlphaProfit Premium Service investment newsletter, you will free up your time for more important and pleasurable activities.

Read More

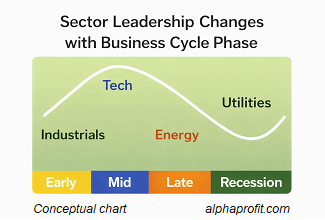

Sector Rotation Methodology

AlphaProfit’s sector selection methodology uses the ValuM multi‑factor framework — Momentum, Valuation, and News Flow — to identify the strongest sectors and themes for the months ahead. This disciplined, rules‑based approach helps you rotate into leadership early and avoid lagging areas before they drag down performance. Read More

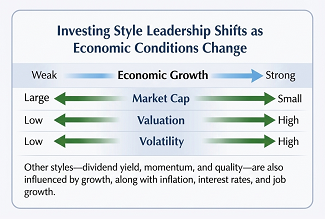

Style Rotation Methodology

AlphaProfit’s ETF Style Rotation strategy helps you stay aligned with the market’s dominant investment styles — growth, value, momentum, quality, and more. You’ll know exactly which styles are leading now and which are fading, helping you position your portfolio for stronger, more consistent returns. Read More

START TO ENJOY THE JOYS OF LIFE AND AVOID THE PAINS OF INVESTING!